Principais Conclusões

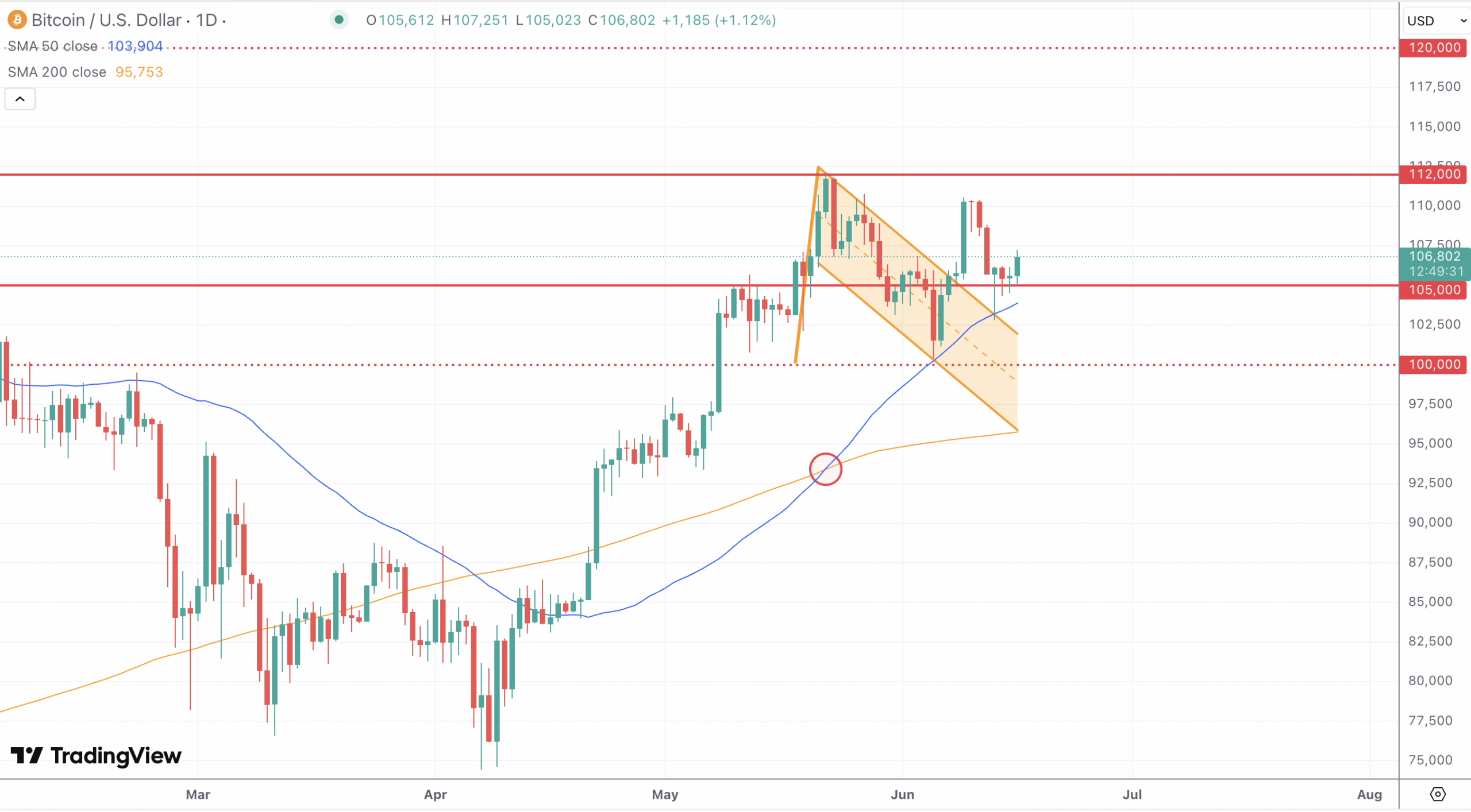

- BTC is trading near $106K with strong upside momentum

- Resistance sits at $112K with upside potential to $120K–$137K

- Key support levels are $105K and $100K

- Golden cross confirms medium-term bullish structure

- Institutional demand and macro tailwinds are supporting the rally

Market Dynamics and Recent Performance

Bitcoin is currently trading around $106,820, continuing its powerful rebound from the recent consolidation near $100,000. The uptrend has been driven by expectations of a dovish shift from the Federal Reserve, weakening dollar momentum, and a surge in institutional interest—including expanding spot ETF holdings and increased corporate accumulation.

With inflation cooling and the macro environment turning risk-on, investor appetite for crypto assets like Bitcoin has reignited. Meanwhile, the technical breakout above recent resistance levels confirms the strength of the bullish sentiment.

Technical and Fundamental Influences

Bitcoin recently broke out of a bullish flag pattern, with technical indicators pointing to continued upside. The formation of a golden cross—where the 50-day moving average crosses above the 200-day—further supports this view.

Immediate resistance sits at $112,000, which marked the prior all-time high. A break above this could pave the way toward $120,000 and eventually $137,000, based on measured move projections. On the downside, support is solid at $105,000, with stronger demand expected at $100,000 if the market retraces.

Momentum remains favorable: RSI is nearing overbought but not extreme, and MACD and trend indicators confirm strength. Still, short-term consolidation is possible as the market digests gains and awaits fresh catalysts.

Fundamentally, Bitcoin remains supported by institutional demand, a weakening U.S. dollar, dovish monetary expectations, and a broader shift in investor confidence toward hard assets.

Looking Forward

In the week ahead, Bitcoin’s path will likely be shaped by:

- S. economic data and Federal Reserve comments, especially around inflation and interest rates

- Continued flows into spot Bitcoin ETFs and institutional portfolios

- Global risk sentiment and the performance of the U.S. dollar

- Key price levels being defended or broken around $105K and $112K

A clean break above $112,000 could ignite a surge toward $120K+, while failure to hold $105,000 would increase the likelihood of a correction toward $100K—a zone many traders will be watching for reentry.