Key Takeaways

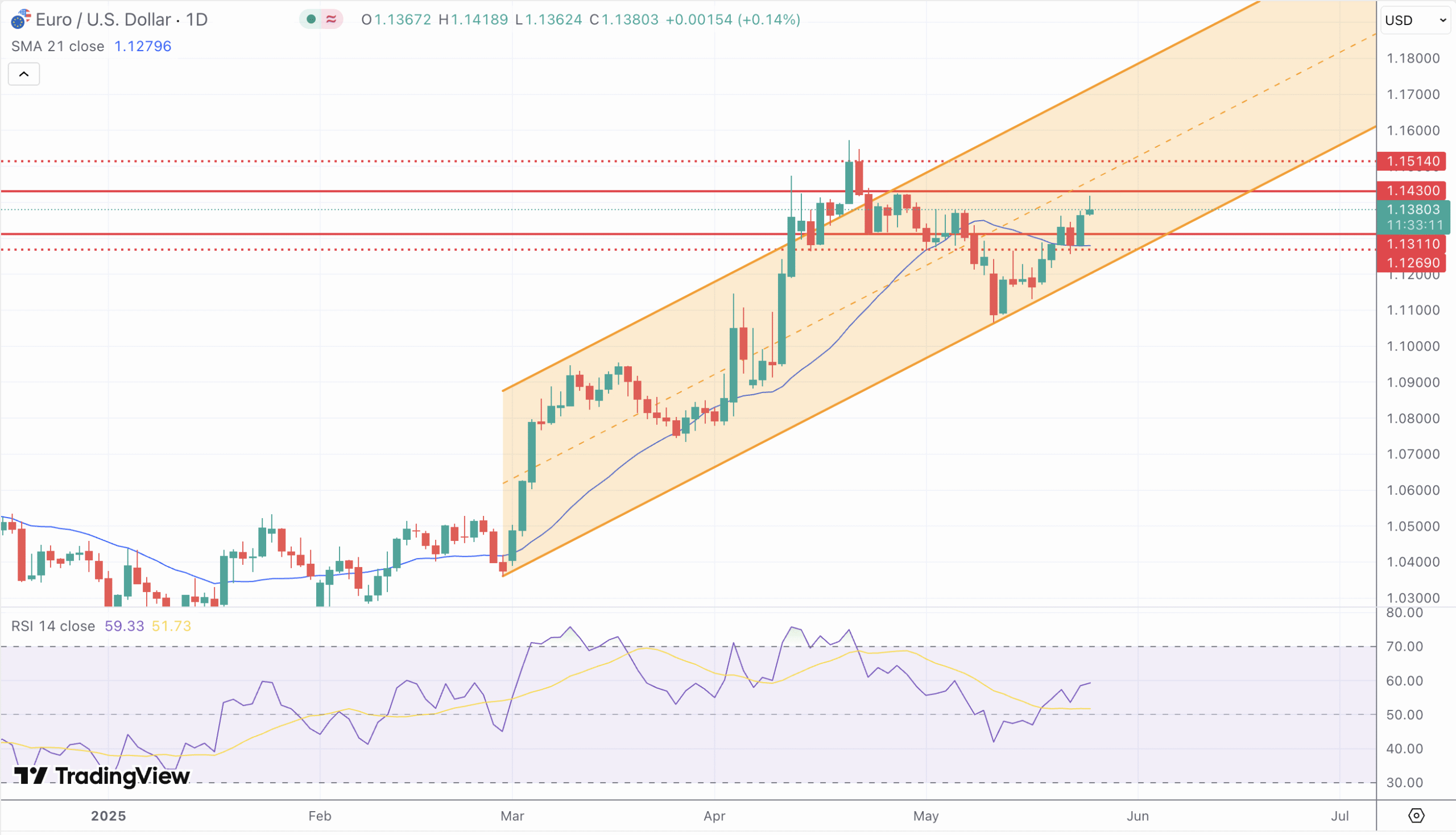

- EUR/USD trades near 1.1380, with resistance at 1.1430 and support at 1.1311.

- S. fiscal concerns and anticipated Federal Reserve rate cuts underpin the euro’s appeal.

- Technical indicators suggest a bullish outlook, contingent on breaking key resistance levels.

- Geopolitical tensions and central bank policies continue to support the euro.

- Upcoming economic data and policy announcements will be critical in determining the pair’s short-term direction.

Market Dynamics and Recent Performance

The EUR/USD pair commenced the week with a modest upward movement, trading near 1.1380. This slight appreciation is attributed to the U.S. administration’s decision to delay the implementation of 50% tariffs on European Union imports, alleviating immediate trade tensions and reducing demand for the U.S. dollar as a safe-haven asset.

The U.S. dollar’s recent weakness is further influenced by fiscal concerns, including a projected increase in the federal deficit and a credit rating downgrade by Moody’s, which anticipates federal debt reaching 134% of GDP by 2035. These factors have contributed to a decline in the U.S. Dollar Index (DXY), currently hovering near 98.78.

Technical and Fundamental Influences

From a technical standpoint, the EUR/USD pair exhibits bullish momentum, with immediate resistance observed at 1.1430. A decisive break above this level could pave the way toward the 1.1465–1.1514 range. Conversely, support is identified at 1.1311, with further downside potential toward 1.1286 and 1.1269.

The Relative Strength Index (RSI) indicates bullish divergence, suggesting continued upward momentum. However, the pair remains within a broader consolidation range, and traders should exercise caution, particularly given the potential for volatility amid low trading volumes due to U.S. and U.K. market holidays.

Fundamentally, the EUR/USD pair is influenced by macroeconomic factors such as U.S. fiscal policy, interest rate expectations, and geopolitical tensions. The Federal Reserve’s anticipated rate cuts enhance the euro’s attractiveness by reducing the opportunity cost of holding non-yielding assets. Moreover, ongoing geopolitical uncertainties and central bank policies continue to provide a supportive backdrop for the euro.

Looking Forward

In the coming week, the EUR/USD pair’s trajectory will likely be shaped by developments in U.S. fiscal policy, Federal Reserve communications, and global economic indicators. Should the U.S. dollar continue to weaken and inflationary pressures persist, the euro may find the impetus to test and potentially surpass the 1.1430 resistance level. However, any signs of economic stabilization or shifts in monetary policy expectations could introduce volatility and test support levels.