Key Takeaways

- Gold is trading around $3,219, down over 7% from April highs.

- Moody’s downgraded U.S. credit rating to Aa1, citing high debt levels.

- Rising U.S. Treasury yields are exerting pressure on gold prices.

- Technical indicators suggest a consolidation phase between $3,169 and $3,299.

- Market focus remains on Federal Reserve policy signals and economic data releases.

Market Dynamics and Recent Performance

Gold (XAU/USD) commenced the week trading around $3,219, reflecting a decline of over 7% from its April peak of $3,500. This downturn is attributed to rising U.S. Treasury yields and a recent downgrade of the U.S. sovereign credit rating by Moody’s from Aaa to Aa1, citing concerns over the nation’s escalating debt, now surpassing $36 trillion. While the downgrade initially bolstered gold’s appeal as a safe-haven asset, the concurrent increase in yields has exerted downward pressure on the non-yielding metal.

Additionally, geopolitical tensions, including renewed tariff threats from the U.S. administration, have contributed to market volatility. Despite these factors, gold has struggled to maintain gains above the $3,250 level, indicating a cautious market sentiment.

Technical and Fundamental Influences

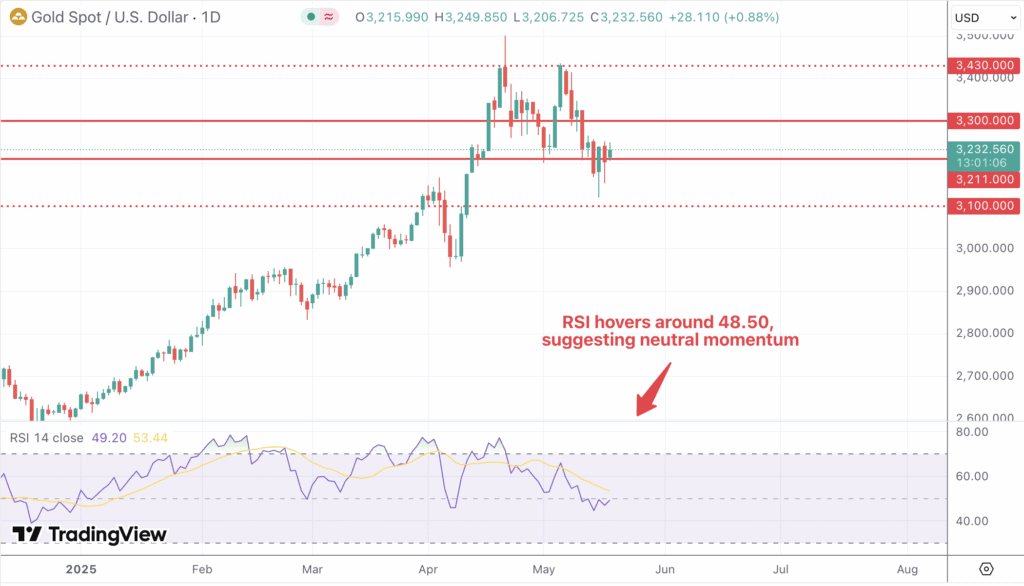

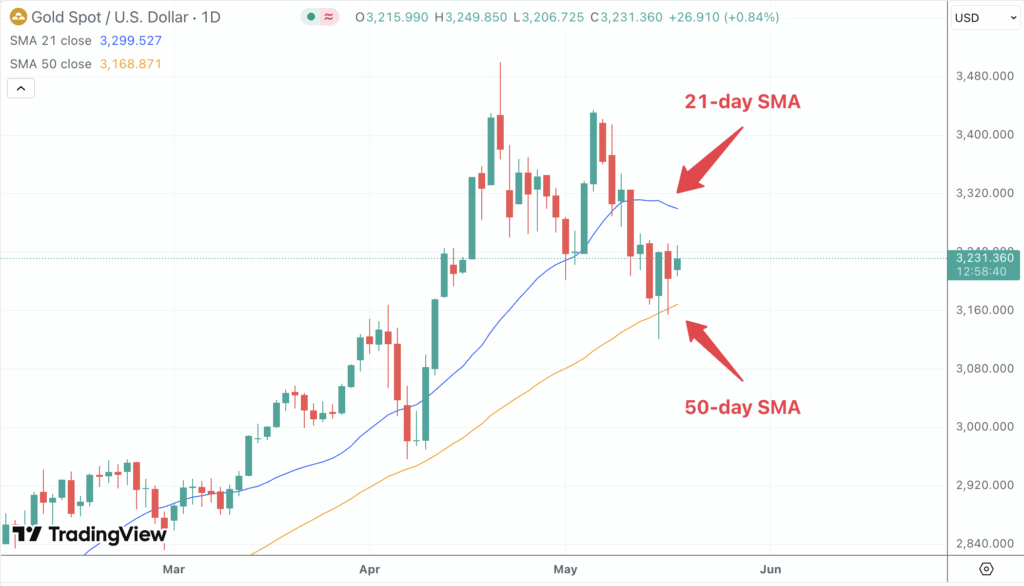

From a technical standpoint, gold is navigating a consolidation phase. The 14-day Relative Strength Index (RSI) hovers around 48.50, suggesting neutral momentum. The price remains confined between the 21-day Simple Moving Average (SMA) at $3,299 and the 50-day SMA at $3,169. A sustained move above the 21-day SMA could signal bullish momentum, while a drop below the 50-day SMA may indicate further downside potential.

Fundamentally, expectations of Federal Reserve rate cuts in the near term are providing some support to gold prices. However, the market remains sensitive to economic indicators and policy statements. Recent data showing a softer U.S. Producer Price Index (PPI) and Consumer Price Index (CPI) have reinforced expectations of monetary easing, yet rising yields continue to challenge gold’s upward trajectory.

Looking Forward

In the coming week, gold’s performance will likely hinge on several key factors:

- Federal Reserve Communications: Any indications of a shift in monetary policy could influence gold prices.

- Economic Data Releases: Upcoming reports on employment and inflation will be closely watched for signs of economic strength or weakness.

- Geopolitical Developments: Ongoing trade negotiations and geopolitical tensions may impact market sentiment and, by extension, gold demand.

Given the current landscape, gold may continue to trade within a range, with potential support around $3,178 and resistance near $3,274. A decisive break above or below these levels could set the tone for the next directional move.