Key Takeaways

- Bitcoin has reached a new all-time high of $111,980, driven by institutional adoption and favorable regulatory developments.

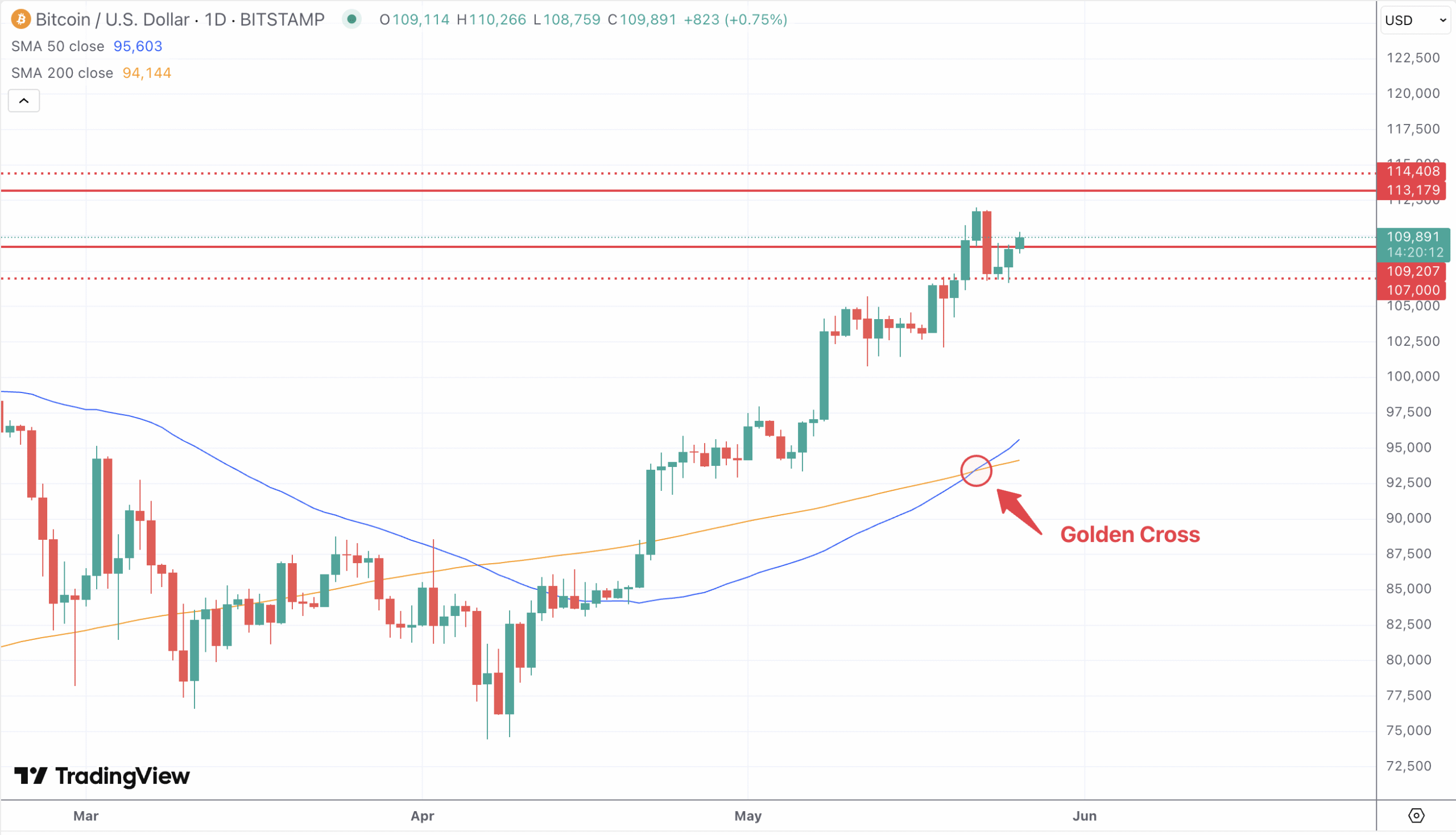

- Technical indicators, including the “golden cross,” suggest continued bullish momentum.

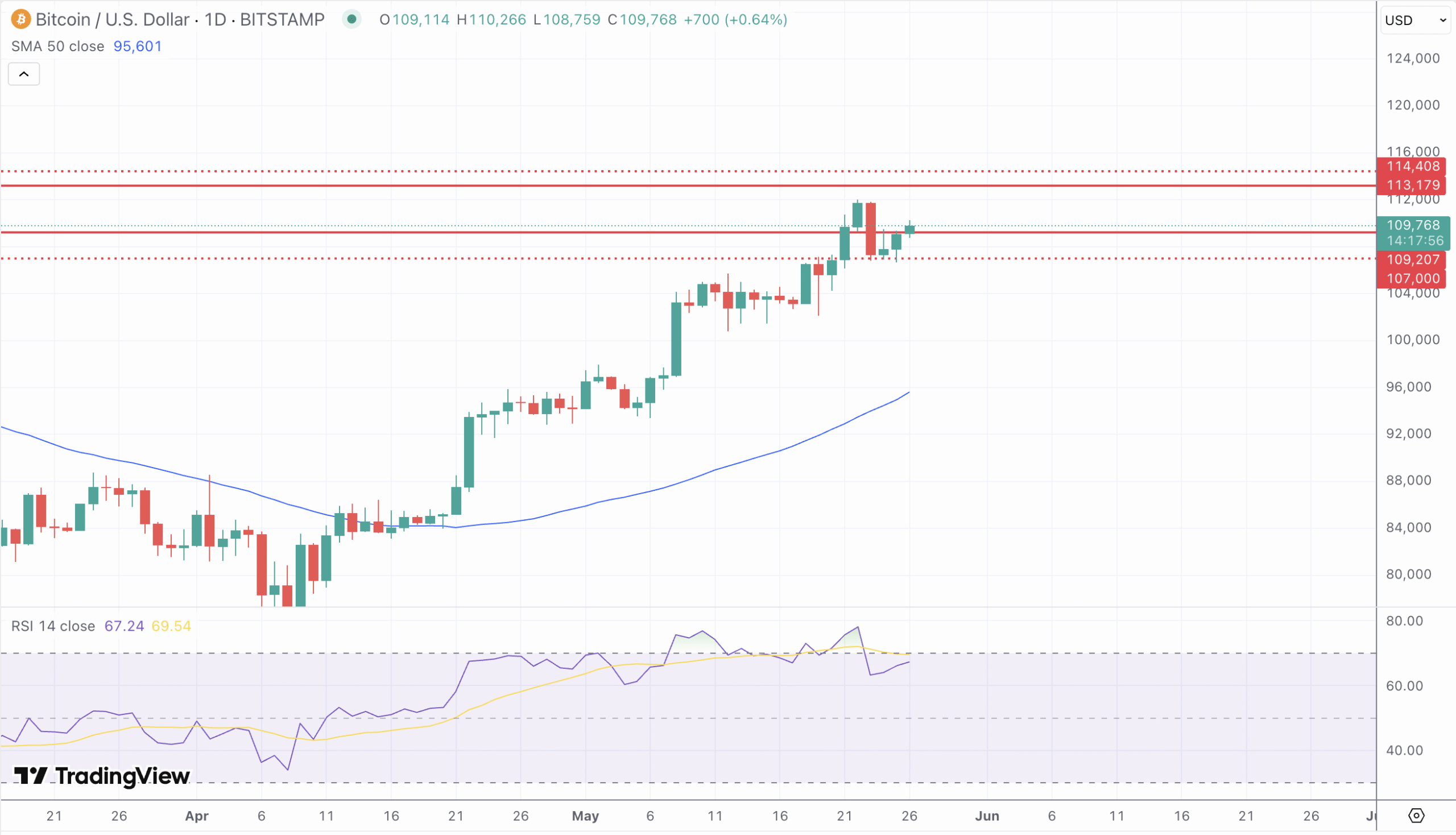

- Key resistance levels are at $113,179 and $114,408, with support at $110,524 and $109,207.

- Analysts forecast potential price targets of $120,000 to $150,000 by the end of 2025, contingent upon sustained institutional interest and regulatory support.

- Investors should monitor macroeconomic indicators and policy announcements for potential impacts on Bitcoin’s price trajectory.

Market Dynamics and Recent Performance

Bitcoin has recently surged past the $110,000 mark, reaching a new all-time high of $111,980. This rally is attributed to several factors, including the U.S. administration’s establishment of a Strategic Bitcoin Reserve , increased institutional adoption, and the approval of spot Bitcoin ETFs. Notably, MicroStrategy’s recent purchase of $765 million in Bitcoin has further fueled investor confidence.

However, the market experienced a brief pullback to $107,357, reflecting typical volatility in the crypto space . Despite this, Bitcoin’s resilience suggests a strong underlying bullish sentiment.

Technical and Fundamental Influences

Bitcoin’s price action indicates a bullish trend, with the formation of a “golden cross”—where the 50-day moving average crosses above the 200-day moving average—signaling potential for continued upward momentum . Key resistance levels to watch are $113,179 and $114,408, while support is observed at $110,524 and $109,207.

The Relative Strength Index (RSI) has rebounded from oversold levels, suggesting renewed buying interest. However, traders should remain cautious of potential reversals, especially if the price fails to maintain support above $110,000.

On the fundamental front, Bitcoin’s ascent is supported by macroeconomic factors such as U.S. fiscal policies and global economic uncertainties. The establishment of the Strategic Bitcoin Reserve by the U.S. government underscores the growing institutional acceptance of cryptocurrencies . Additionally, the approval of spot Bitcoin ETFs has opened new avenues for investment, attracting both retail and institutional investors.

Analysts project that Bitcoin could reach $120,000 in the near term, with some forecasts suggesting a potential rise to $150,000 by the end of 2025 . However, these projections are contingent upon continued institutional adoption and favorable regulatory developments.

Looking Forward

In the coming week, Bitcoin’s trajectory will likely be influenced by macroeconomic indicators, regulatory developments, and market sentiment. Should the bullish momentum persist, the next resistance levels to monitor are $113,179 and $114,408. Conversely, a break below the $110,000 support level could signal a potential correction.

Investors should also keep an eye on upcoming economic data releases and policy announcements, as these could impact market dynamics. Given the current market conditions, a cautious yet optimistic approach is advisable.