Key Takeaways:

- US Economic Data: The upcoming US inflation data will be crucial in shaping market expectations for the Federal Reserve’s policy decisions. Weaker inflation could support the Euro, while stronger data could boost the Dollar.

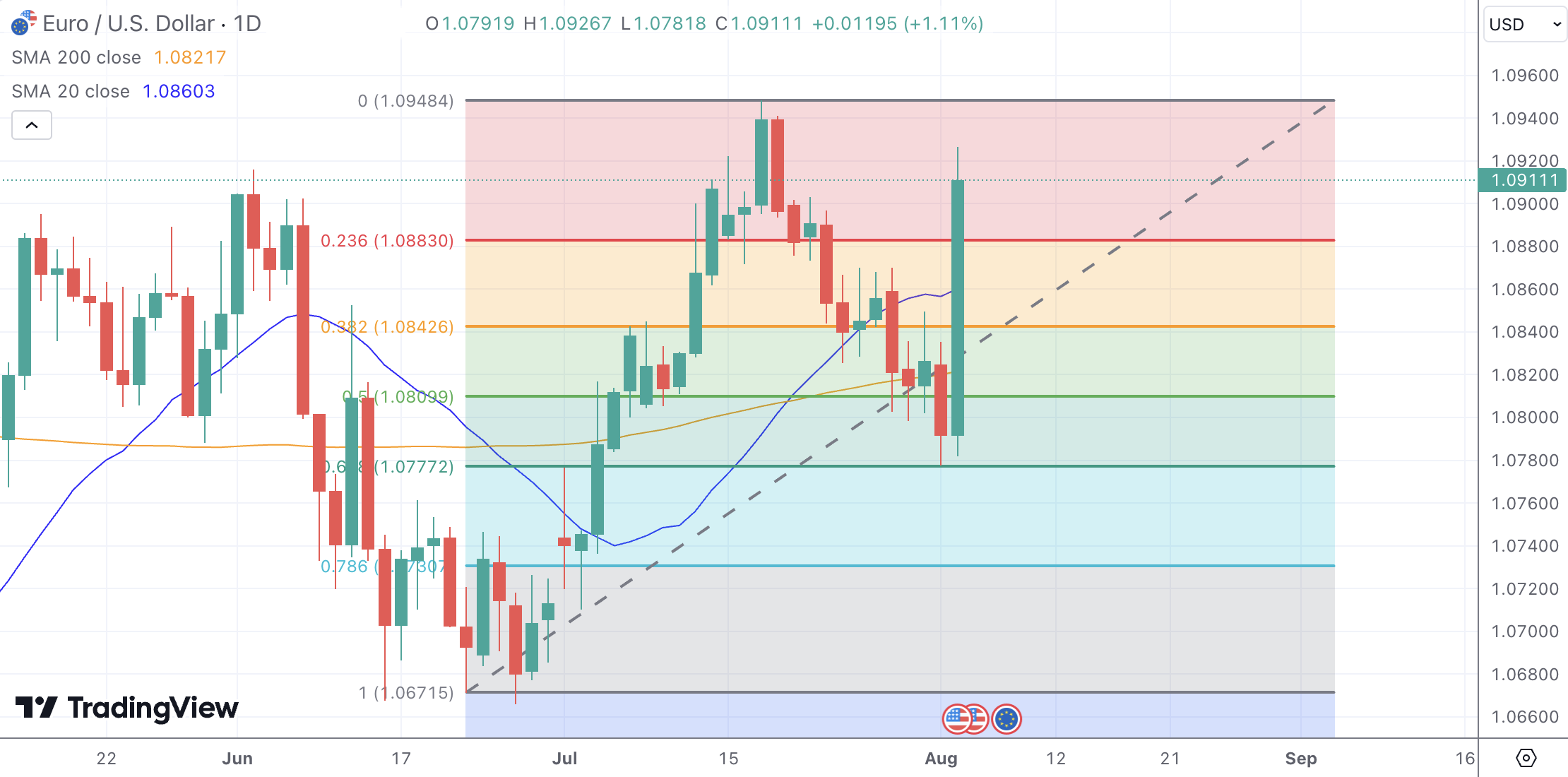

- Technical Levels: The EUR/USD pair faces resistance at 1.0910-1.0925 and 1.0945 , with support at 1.0780, 1.0740, and 1.0700.

- ECB Communications: The HCOB Services PMI and Composite PMI figures will provide insights into the Eurozone’s economic health and influence the ECB’s policy stance.

Market Dynamics and Recent Performance

The EUR/USD pair experienced a week marked by choppy and sideways action, struggling to find clear direction amidst mixed economic signals. The pair fluctuated around the 1.0900 level, reflecting the market’s uncertainty. The Euro found some support from weaker US data, with the latest US employment report showing an unexpected rise in the unemployment rate to 4.3%, which led to speculation of a more dovish stance from the Federal Reserve. This economic backdrop caused the US Dollar to lose ground, allowing the Euro to gain some traction.

Technical and Fundamental Influences

Technically, the EUR/USD pair faces strong resistance at the 1.0910-1.0925 area. If the pair can stabilize above this level, it could find further resistance at 1.0948 (Fibonacci 0.0% retracement of the latest uptrend). On the downside, immediate support is at 1.0780 (Fibonacci 61.8% retracement), followed by 1.0740 (Fibonacci 78.6% retracement) and 1.0700 (psychological level).

Fundamentally, the rise in the US unemployment rate and weaker-than-expected job numbers have increased market speculation that the Federal Reserve might adopt a more dovish stance, potentially leading to rate cuts. This speculation has pressured the US Dollar, providing a temporary boost to the Euro. However, the Euro’s gains have been limited by persistent economic concerns within the Eurozone, particularly around inflation and growth.

Looking Forward

In the coming week, the focus will be on key economic data releases and central bank communications. Investors will closely monitor the US inflation data and any further comments from Federal Reserve officials. A softer inflation reading could reinforce expectations for a dovish Fed, weakening the US Dollar and supporting the EUR/USD pair. Conversely, stronger inflation data could revive expectations of further rate hikes, boosting the Dollar.

The Eurozone’s economic calendar includes several important releases, including the HCOB Services PMI and Composite PMI figures. These indicators will provide insights into the health of the Eurozone economy and could influence the ECB’s future policy decisions. Additionally, geopolitical developments and broader market sentiment will continue to play significant roles in the pair’s movements.