Key Takeaways

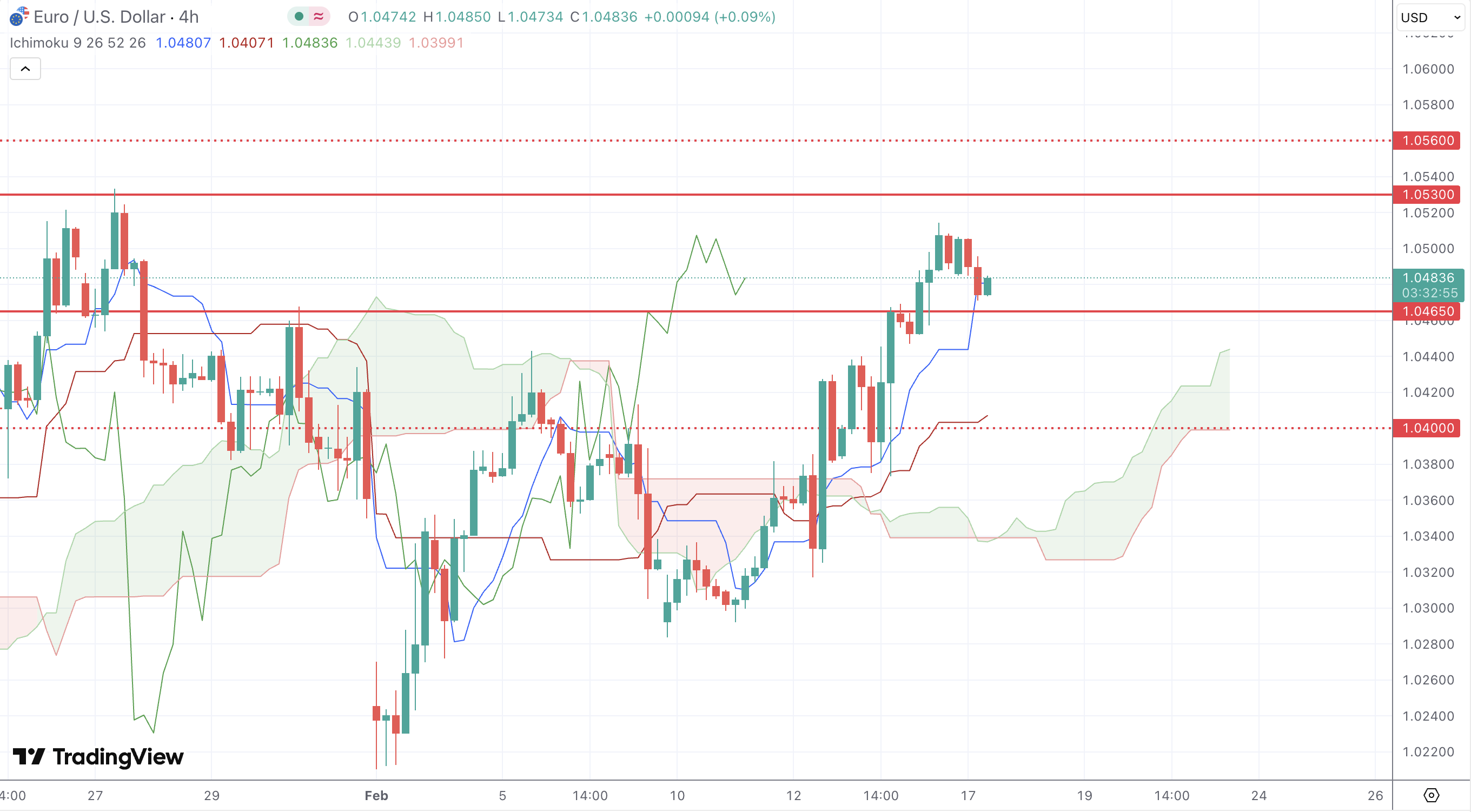

- The EUR/USD is consolidating near the 1.0500 level, reflecting recent economic data and market sentiment.

- Technical indicators suggest potential for further gains, with key resistance at 1.0530 and support at 1.0465.

- S. trade policies, Federal Reserve rate projections, and eurozone economic performance are critical factors influencing the pair’s trajectory.

- Market participants should closely watch upcoming economic releases and policy announcements for directional cues.

Market Dynamics and Recent Performance

As of February 17, 2025, the EUR/USD pair is trading near the 1.0500 mark, consolidating gains from the previous week. This movement follows the release of robust U.S. inflation data, with January figures showing a rise to 3%, indicating persistent price pressures. Concurrently, Eurostat reported that the eurozone economy expanded by 0.1% in the fourth quarter, translating to a year-over-year growth of 0.9%. These developments have contributed to the pair’s recent bullish momentum.

Technical and Fundamental Influences

Technically, the EUR/USD is navigating within a bullish channel, with immediate resistance at the 1.0500 psychological level. A decisive break above this could open the path toward 1.0530 and 1.0560. Support is observed around 1.0465; a drop below this may trigger further declines toward 1.0400. The Ichimoku indicator suggests potential for additional gains, as the pair trades above the cloud, indicating bullish momentum.

Fundamentally, the euro’s performance is influenced by several factors:

- S. Trade Policies: President Trump’s recent proposals for new tariffs have introduced uncertainty into the markets, potentially impacting global trade dynamics and investor sentiment.

- Federal Reserve Outlook: Despite inflation remaining above target, the Federal Reserve has signaled a cautious approach to rate cuts in 2025, projecting only two reductions. This stance supports the U.S. dollar, influencing the EUR/USD dynamics.

- Eurozone Economic Performance: The modest growth in the eurozone’s GDP highlights ongoing economic challenges, which may affect the European Central Bank’s monetary policy decisions and, consequently, the euro’s valuation.

Looking Forward

Analysts anticipate that the EUR/USD may consolidate within the 1.0455 to 1.0515 range in the near term, as the market digests recent economic data and awaits further policy signals. The outlook remains cautiously optimistic, with potential for gains if the pair sustains momentum above key resistance levels. Traders should monitor upcoming economic releases, including the Federal Open Market Committee (FOMC) meeting minutes and eurozone economic indicators, for insights into future monetary policy and potential market movements.