Principais Conclusões

- Support cluster: $100K/50‑day EMA remains a crucial foundation for price stability.

- Bullish breakout above $108,000 could unlock targets at $112K, then $115K–$120K.

- Downside risk looms if Bitcoin falls below $105K—loss of $100K could prompt slips toward $95K.

- Macro and on‑chain forces (ETF flows, whale accumulation, Fed data) remain significant catalysts.

- Watch for week structure: Reactions to economic data and volume into breakouts will be defining.

Market Dynamics and Recent Performance

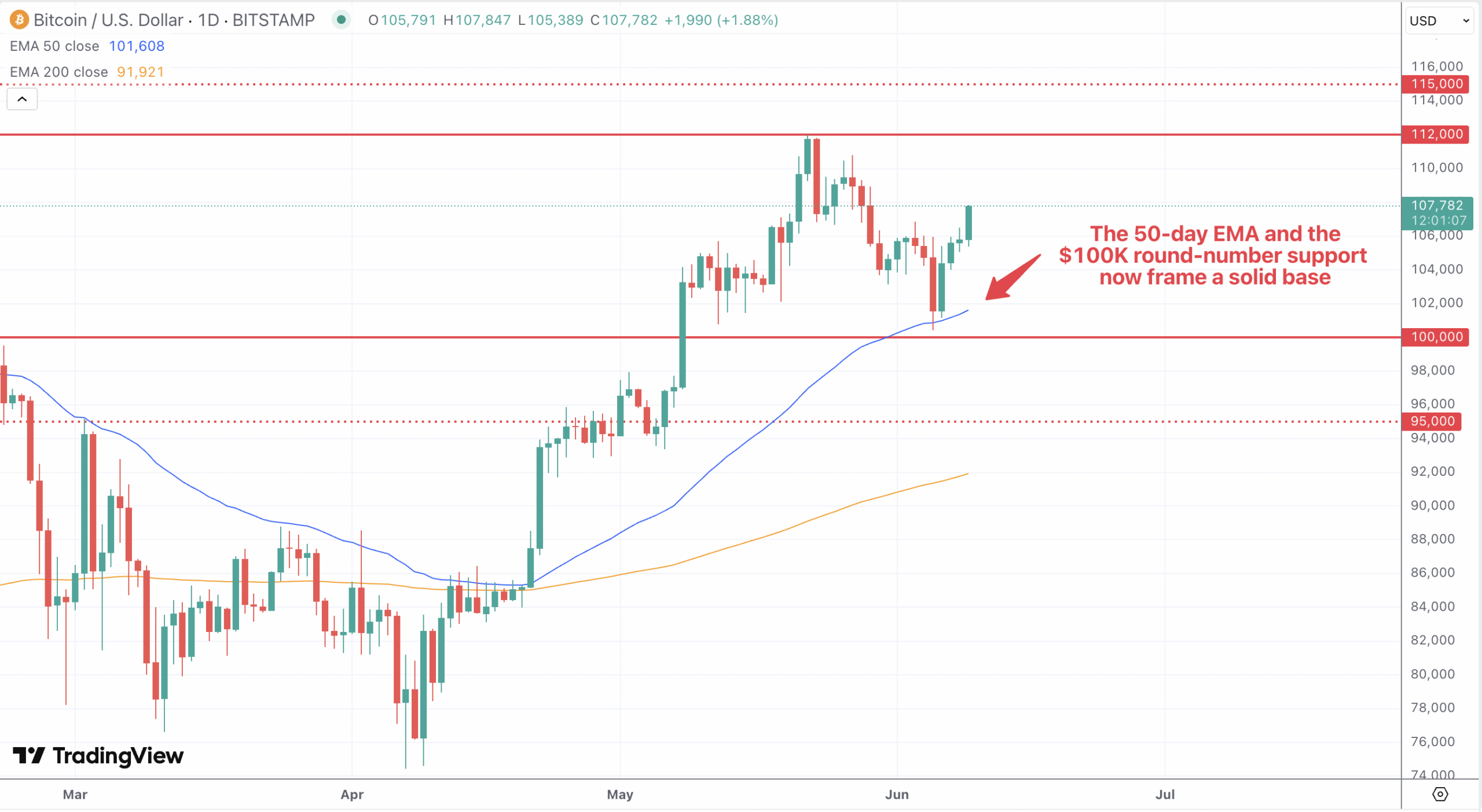

Bitcoin currently trades around $107,500, rebounding strongly from the $100,000–$105,000 support zone. This bounce coincided with the 50‑day EMA acting as a key inflection point, helping prices recover after a dip to $100K on June 5. Optimism in crypto markets is resurfacing, partly fueled by increasing activity around US‑China trade talks and macroeconomic sentiment, which have buoyed speculative demand.

Technical and Fundamental Influences

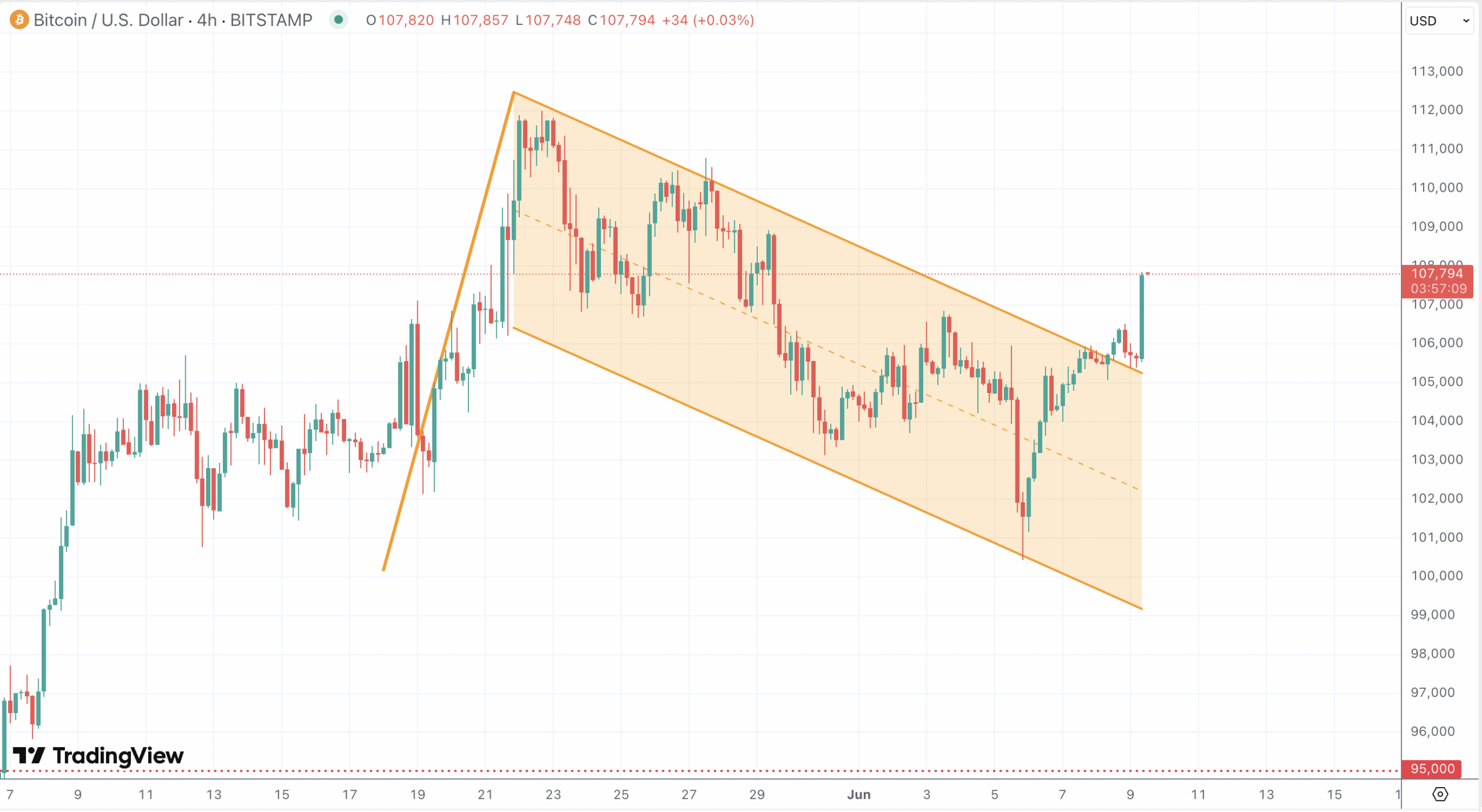

Technically, BTC is building a bullish case: the 50‑day EMA and the $100K round‑number support now frame a solid base. A breakout above $112,000 would likely open the door to $115K–$120K, based on measured-move targets from bullish chart patterns. A bullish flag on the 4‑hour chart, with immediate resistance between $105,880–$106,934, hints that once cleared, upside momentum could ramp up toward 111,500, possibly higher if followed by strong volume.

By contrast, a drop below the 50-day EMA and $100,000 could trigger a correction to around $95,000, with the 200‑day EMA offering key downside support. On shorter intraday charts, sentiment remains cautiously optimistic—over 90% of recent moving-average signals point upward, though a minor MACD cross overbuy level suggests possible short-term choppiness.

Fundamentally, rising institutional inflows via Bitcoin ETFs and sustained on‑chain accumulation by whales continue to provide underlying support. Several analyst projections place the near-term target at $120,000–$125,000, with some scenarios extending to $150,000 later in 2025. Macro events—including US CPI and Fed policy shifts—could significantly impact momentum, as Bitcoin often responds strongly to rate‑cut expectations.

Looking Forward

Next week’s price path will hinge on a few key variables:

- A clean breakout above $108,000, confirmed by volume, could fully validate the bullish flag and propel BTC higher.

- Sustaining that breakout may drive price toward $112,000, with potential to reach $115K–$120K in the medium term.

- A failure to break higher, especially after major macro data or global headlines, may pressure BTC back below $105K, testing the 50‑day EMA again.

- A drop beneath $100,000 would risk triggering a deeper decline toward $95K, though the 200‑day EMA could cap losses.

Sentiment is currently tilted bullish, but volatility remains elevated—on‑chain data indicate possible whipsaw behavior. Traders should also watch weekly patterns: mid‑week inflows often align with key US data releases and ETF activity.