Key Takeaways

- EUR/USD is hovering at 1582, near the top of its ascending channel.

- 1600–1.1620 (channel resistance), then 1.1632.

- 1550 (20-SMA), followed by 1.1500 and 1.1460.

- RSI in mid‑60 s, STOCH overbought, MACD histogram supportive – bullish but cautious.

- ECB’s rate path and growing rate differential favor euro; Fed dovishness would reinforce upside.

- Dollar recovery on strong U.S. data or hawkish Fed; geopolitical surprises could shift sentiment.

Market Dynamics and Recent Performance

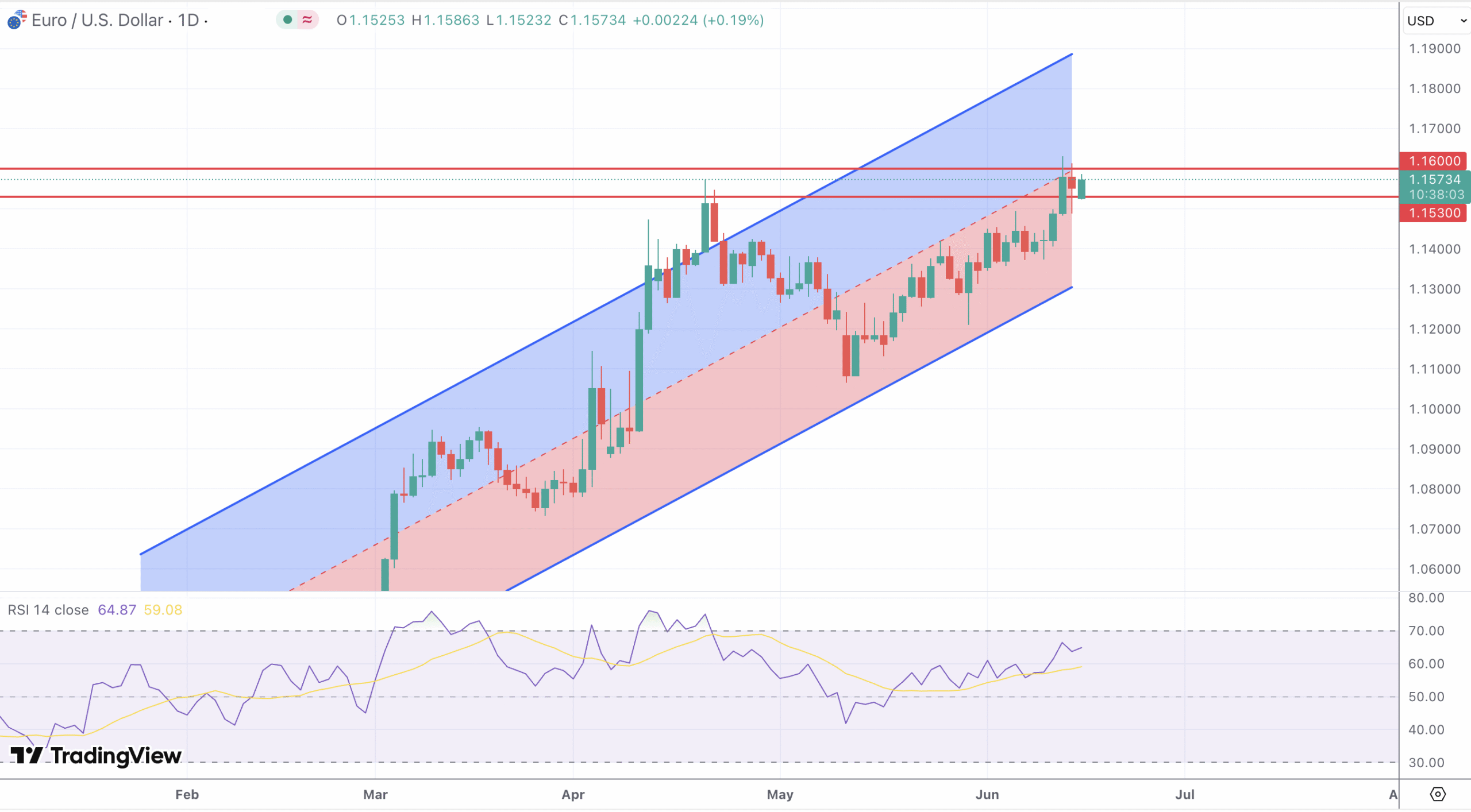

EUR/USD is trading near 1.1582, having extended its climb from the 1.1550 region amid broad dollar weakness. The pair has rallied over 1% in recent days, supported by easing U.S. inflation expectations and reduced demand for U.S. Treasuries. Meanwhile, the ECB has signaled contentment with moderate euro strength—despite the euro trading at multi‑year highs (~1.1632)—and indicated that a further cut in interest rates may still lie ahead.

Technical and Fundamental Influences

On the technical front, EUR/USD is trading at the top of an ascending regression channel, with four‑hour and daily charts showing momentum holding firm. RSI is in the mid-60s and STOCH indicates overbought conditions, suggesting persistent bullish strength but also potential for short-term consolidation . Moving averages (5-, 10-, 20-, 50-day SMAs and EMAs) are aligned bullishly, reinforcing the uptrend.

Immediate resistance lies around 1.1600–1.1620—the upper edge of the channel and a psychological level—and the post‑high tether near 1.1632 . Support levels can be found at 1.1530–1.1550, aligning with the 20-period SMA and prior consolidation zone . A break below 1.1550 could expose deeper support near 1.1500, followed by 1.1460 (50-period SMA).

Fundamentally, the growing interest rate differential—driven by the ECB’s easing bias (about 2%) and a more cautious Fed stance (rates near 4.25–4.5%)—is weighing on the dollar and benefiting EUR/USD. Geopolitical easing in the Middle East has also softened safe-haven demand for the dollar, further supporting the euro .

Looking Forward

The near-term trajectory for EUR/USD hinges on several key factors:

- Fed communications and U.S. inflation data – Any dovish signals or softer prints should bolster EUR/USD, potentially triggering a push to 1.1600–1.1620 and beyond.

- ECB commentary – More dovish rhetoric or an additional cut could further widen the yield gap, supporting additional euro strength.

- Broader risk sentiment – A shift toward global risk-on boosts sentiment for euro and equities; renewed risk-off could strengthen the dollar.

Technically, a sustained break above 1.1600–1.1620 could clear the path to 1.1660 and possibly 1.1700. Alternatively, a reversal below 1.1550 opens the door to 1.1500, and a deeper drop toward 1.1460 could follow.