重要なポイント

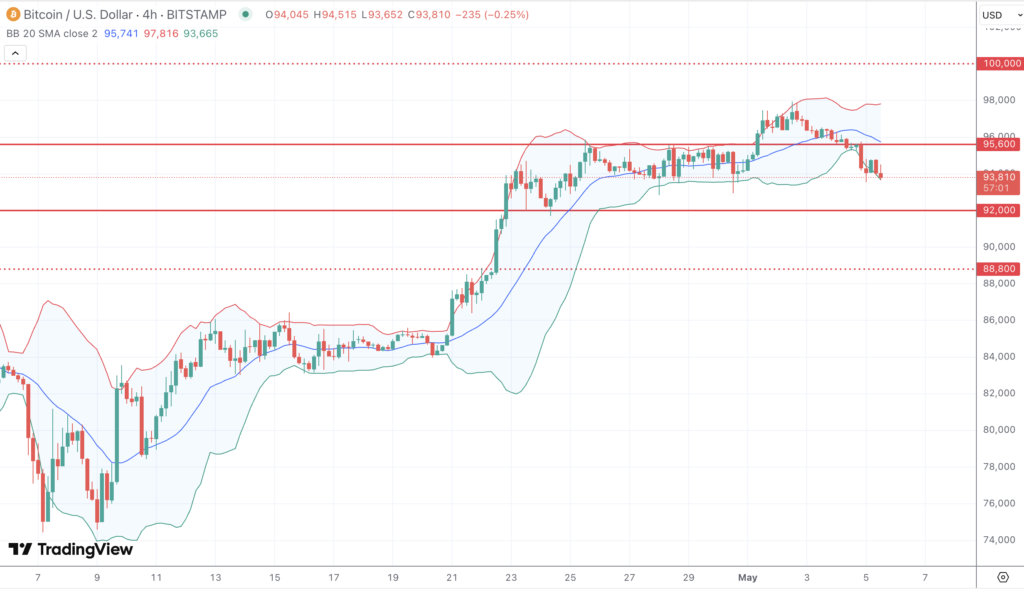

- Bitcoin is trading near $94,000, with immediate resistance at $95,600 and major resistance at $100,000.

- Technicals suggest a potential breakout, with Bollinger Band compression and MACD momentum building.

- Support zones to watch are $92,000 and $88,800; a break below could lead to $85,000 or lower.

- All eyes are on the Fed this week — a dovish tone could propel BTC past the $100k milestone.

- Volatility is expected to spike — traders should prepare for a directional move.

市場の動向と最近のパフォーマンス

Bitcoin kicked off the week hovering around $94,000, showing signs of a healthy pause after nearly tagging $97,000 late last week. While some traders feared a sharper correction, BTC has held its ground impressively well — especially in the face of macro uncertainty. Risk assets as a whole are walking on eggshells ahead of the upcoming Fed decision, but Bitcoin continues to act more like digital gold than a high-beta tech proxy.

A mix of subdued dollar strength and steady institutional demand is keeping BTC afloat. Meanwhile, ETF inflows have stabilized, and the halving effect — while no longer fresh news — still adds a speculative tailwind. The market isn’t in full risk-on mode, but it’s not risk-off either. It’s more like “watch-and-wait” — and Bitcoin is staying coiled, ready to react.

テクニカルおよびファンダメンタルの影響

Bitcoin’s chart is starting to look like a spring about to snap. After a brief but convincing bounce off the $92,000 zone, price is compressing just below the $95,600 resistance. The Bollinger Bands on the 4-hour and daily charts are tightening — a classic pre-breakout signal. Volatility is low, but tension is high.

The MACD on the daily just flipped into positive territory, while the RSI remains in a bullish-but-not-overbought range around 58. These are the kind of setups traders love: momentum starting to build while there’s still room to run. Above $96,000, there’s not much resistance until the psychological $100,000 barrier, and beyond that, $102,400 marks the top of a broader ascending channel from late February.

On the downside, $92,000 is the first line of defense, followed by $88,800 — a level that lines up with the 38.2% Fib retracement and past breakout structure. If both levels crack, $85,000 could come into play fast, especially if dollar strength returns post-Fed.

And speaking of the Fed — it’s the wildcard this week. A dovish tone could be the green light bulls have been waiting for. But if Powell leans hawkish or signals delayed cuts, we may see some risk-off rebalancing, at least temporarily.

今後の見通し

The Fed’s policy statement will be the main catalyst this week — not just for Bitcoin, but across the board. The question is whether the central bank will stay the course on rate cuts or suggest a longer wait-and-see approach. Either way, Bitcoin is gearing up for a move, and traders will be watching for confirmation on the charts.

Beyond monetary policy, keep an eye on regulatory chatter — particularly in the U.S. If ETF-related news turns positive or crypto legislation gets a friendly push, it could pour gasoline on any bullish fire.