Key Takeaways:

- US Economic Data: The upcoming GDP and PCE Price Index reports will be critical in shaping market expectations for the Fed’s policy decisions.

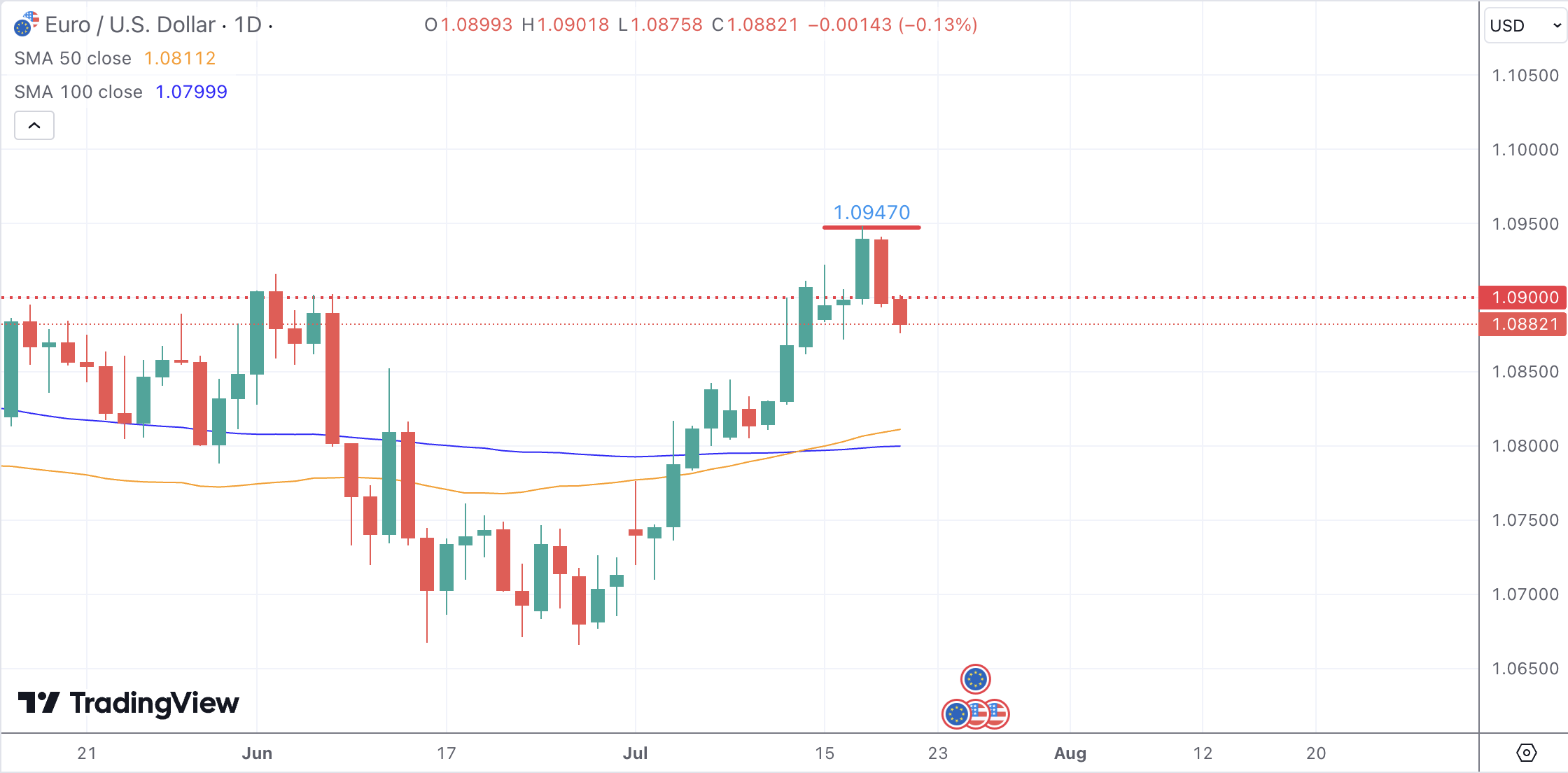

- Technical Levels: Resistance at 1.0948, 1.0981, and 1.1000, with support at 1.0872, 1.0793, and 1.0709, will be crucial in determining the pair’s direction.

- Fed Rate Cut Speculation: Market expectations for a September rate cut by the Fed are influencing US Dollar movements. Positive economic data could strengthen the Dollar, while weaker data could increase pressure for a rate cut.

- ECB Comments: The ECB’s stance and comments from its officials will be closely monitored for any indications of future monetary policy adjustments.

Market Dynamics and Recent Performance

The EUR/USD pair experienced significant fluctuations last week, closing just below the 1.0900 mark. The pair hit a multi-month high of 1.0947 mid-week before retreating. This movement was influenced by the European Central Bank’s (ECB) decision to keep interest rates unchanged, which provided little guidance for future monetary policy. Dovish comments from ECB officials and a risk-averse market atmosphere also contributed to the pair’s decline.

At the start of the week, optimism about a potential rate cut by the Federal Reserve (Fed) in September pressured the US Dollar. This sentiment was supported by Fed Chair Jerome Powell’s remarks, which suggested confidence in achieving the Fed’s inflation targets. However, better-than-expected US Retail Sales data and resilient economic indicators helped the US Dollar regain some strength later in the week.

Technical and Fundamental Influences

Technically, the EUR/USD pair is currently pulling back from its channel resistance, with the price sitting above the 22-SMA, indicating bullish momentum. The Relative Strength Index (RSI) remains above 50, suggesting that bulls are in control. However, the pair faces resistance at 1.0948, 1.0981, and the psychological 1.1000 level. On the downside, support is seen at 1.0872, followed by the 200-SMA at 1.0793 and 1.0709. A break below these levels could expose the 1.0666 region.

Fundamentally, the focus will be on the upcoming US economic data, including the Gross Domestic Product (GDP) and Durable Goods Orders. The GDP report, which showed a 1.4% expansion in the previous quarter, will be closely watched for any signs of economic deterioration that could pressure the Fed to lower borrowing costs. Additionally, Durable Goods Orders will provide insights into the state of demand and influence the outlook for Fed rate cuts.

Looking Forward

In the coming week, the EUR/USD pair will be influenced by key economic releases and central bank communications. The US GDP and PCE Price Index data will be pivotal in shaping market expectations for the Fed’s policy decisions. A stronger-than-expected GDP and PCE reading could reinforce the Fed’s confidence in achieving its inflation targets, potentially strengthening the US Dollar. Conversely, weaker data could fuel expectations for a rate cut in September, putting pressure on the Dollar.

The ECB’s stance and comments from its officials will also play a crucial role. Any indications of future monetary policy adjustments or concerns about inflation could impact the Euro. Additionally, geopolitical developments and market sentiment will continue to drive the pair’s movements.