Key Takeaways

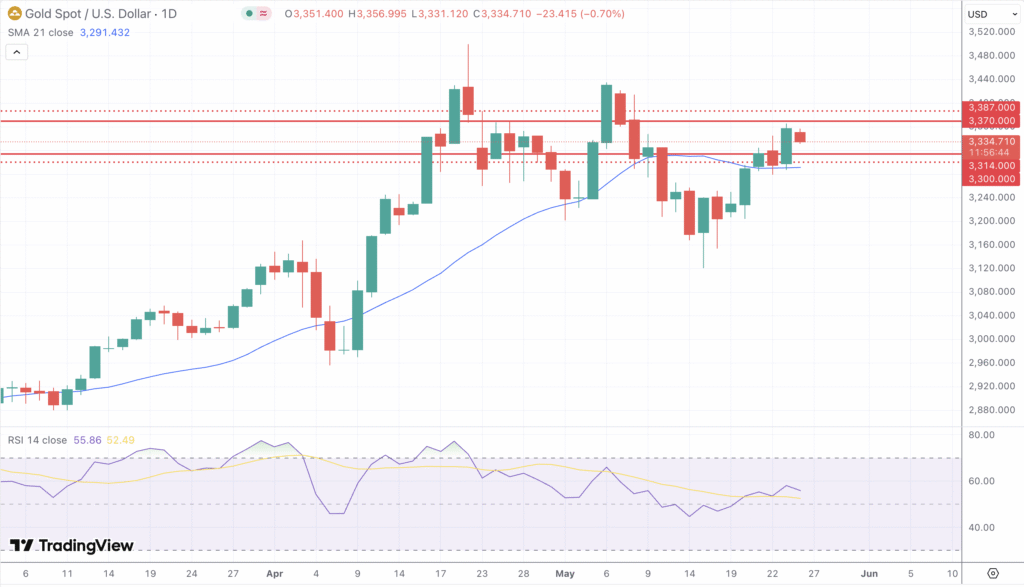

- Gold trades near $3,346, with resistance at $3,364–$3,370 and support at $3,314.

- S. fiscal concerns and anticipated Federal Reserve rate cuts underpin gold’s appeal.

- Technical indicators suggest a neutral to bullish outlook, contingent on breaking key resistance levels.

- Geopolitical tensions and central bank purchases continue to support gold prices.

- Upcoming economic data and policy announcements will be critical in determining gold’s short-term direction.

Market Dynamics and Recent Performance

Gold commenced the week with a slight pullback, trading near $3,346 per ounce after reaching a two-week high of $3,365 last Friday. This minor decline coincides with the U.S. administration’s decision to postpone the implementation of 50% tariffs on European Union imports from June 1 to July 9, reducing immediate safe-haven demand. Despite this, the downward movement lacks strong bearish momentum, indicating underlying support for the precious metal.

The U.S. dollar’s recent weakness, influenced by fiscal concerns and expectations of Federal Reserve rate cuts, continues to bolster gold prices. Additionally, the anticipated $4 trillion increase in the U.S. deficit over the next decade adds to the metal’s appeal as a hedge against economic uncertainty.

Technical and Fundamental Influences

From a technical perspective, gold faces resistance around the $3,364–$3,370 range. A decisive break above this zone could pave the way toward the $3,387 level, with potential to challenge the $3,400 mark. Conversely, support is observed at $3,314, followed by $3,300 and $3,288. The 21-day Simple Moving Average (SMA) at $3,289 serves as a critical support level; a close below this could signal further downside toward the 50-day SMA at $3,185.

Fundamentally, gold remains influenced by macroeconomic factors such as U.S. fiscal policy, interest rate expectations, and geopolitical tensions. The Federal Reserve’s anticipated rate cuts enhance gold’s attractiveness by reducing the opportunity cost of holding non-yielding assets. Moreover, ongoing geopolitical uncertainties and central bank purchases continue to provide a supportive backdrop for gold prices.

Looking Forward

In the coming week, gold’s trajectory will likely be shaped by developments in U.S. fiscal policy, Federal Reserve communications, and global economic indicators. Should the U.S. dollar continue to weaken and inflationary pressures persist, gold may find the impetus to test and potentially surpass the $3,370 resistance level. However, any signs of economic stabilization or shifts in monetary policy expectations could introduce volatility and test support levels.