Key Takeaways

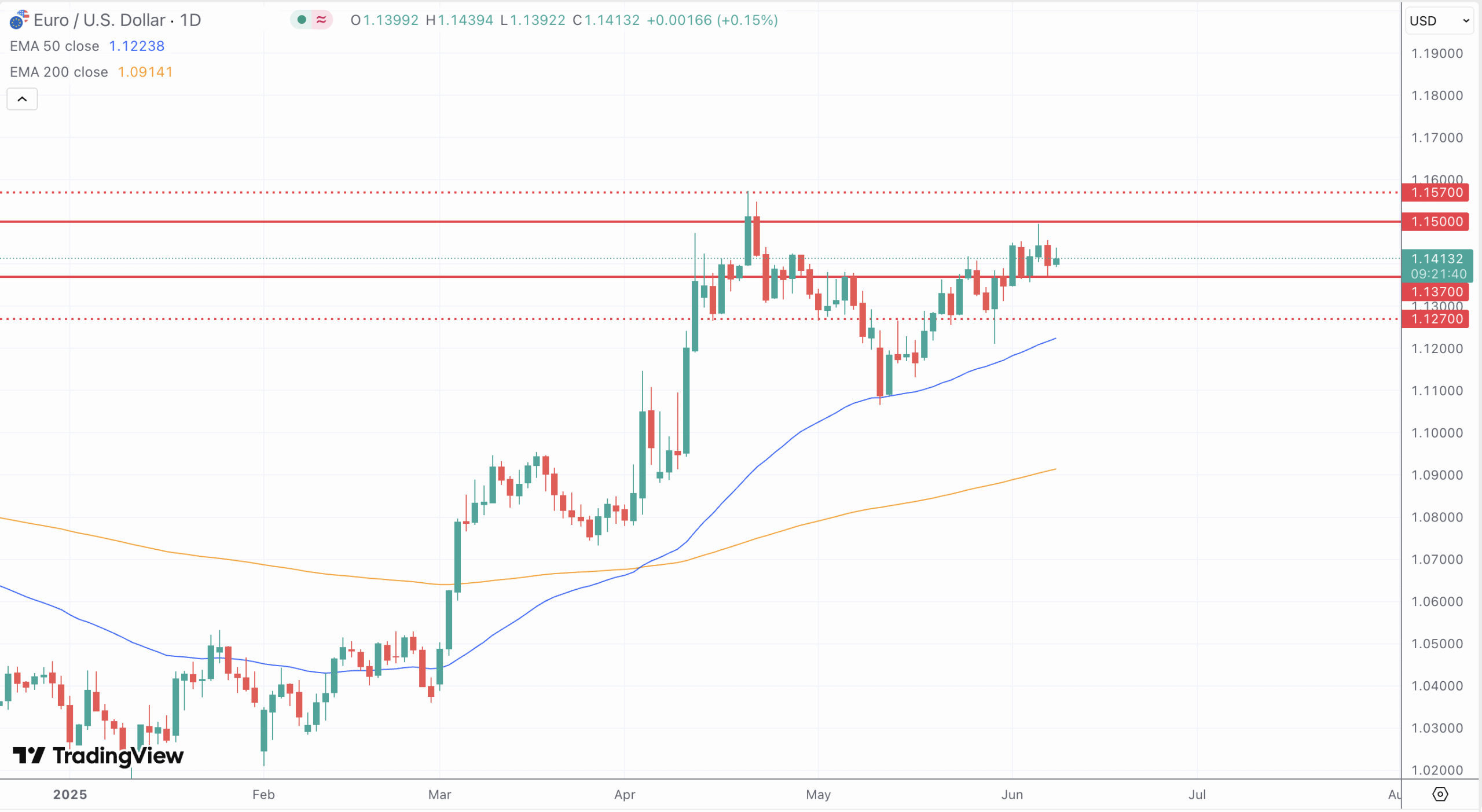

- EUR/USD is consolidating within the 1370–1.1500 range, maintaining its bullish bias but lacking immediate follow-through.

- Strong resistance at 1570 must be cleared for the pair to aim toward 1.1700 and beyond.

- Technical signals suggest possible short-term reversal or slowdown, with a potential move toward 1350 if bearish momentum takes hold.

- US CPI and labor data will likely set the tone for the next directional push.

- Short-term volume clusters near 1370 could serve as key decision zones for intraday traders.

Market Dynamics and Recent Performance

EUR/USD traded within a tight range around 1.1450–1.1500 over the past few sessions, stabilizing after a modest retracement from monthly highs. The pair had previously climbed from the 1.1060 area amid broad dollar weakness, spurred by soft economic sentiment and increased demand for risk assets. However, the upside momentum faced headwinds following better-than-expected US jobs data. The May non-farm payrolls came in at 139,000, slightly above expectations, while unemployment remained at 4.2%, cooling market enthusiasm for near-term Fed rate cuts and briefly lifting the dollar.

That said, broader sentiment still leans against the dollar. Growing concerns over the sustainability of US debt levels and potential policy shifts from the Fed later this year are contributing to demand for alternative currencies, including the euro. Options market positioning also shows a skew toward euro strength, with many investors hedging against prolonged dollar underperformance.

Technical and Fundamental Influences

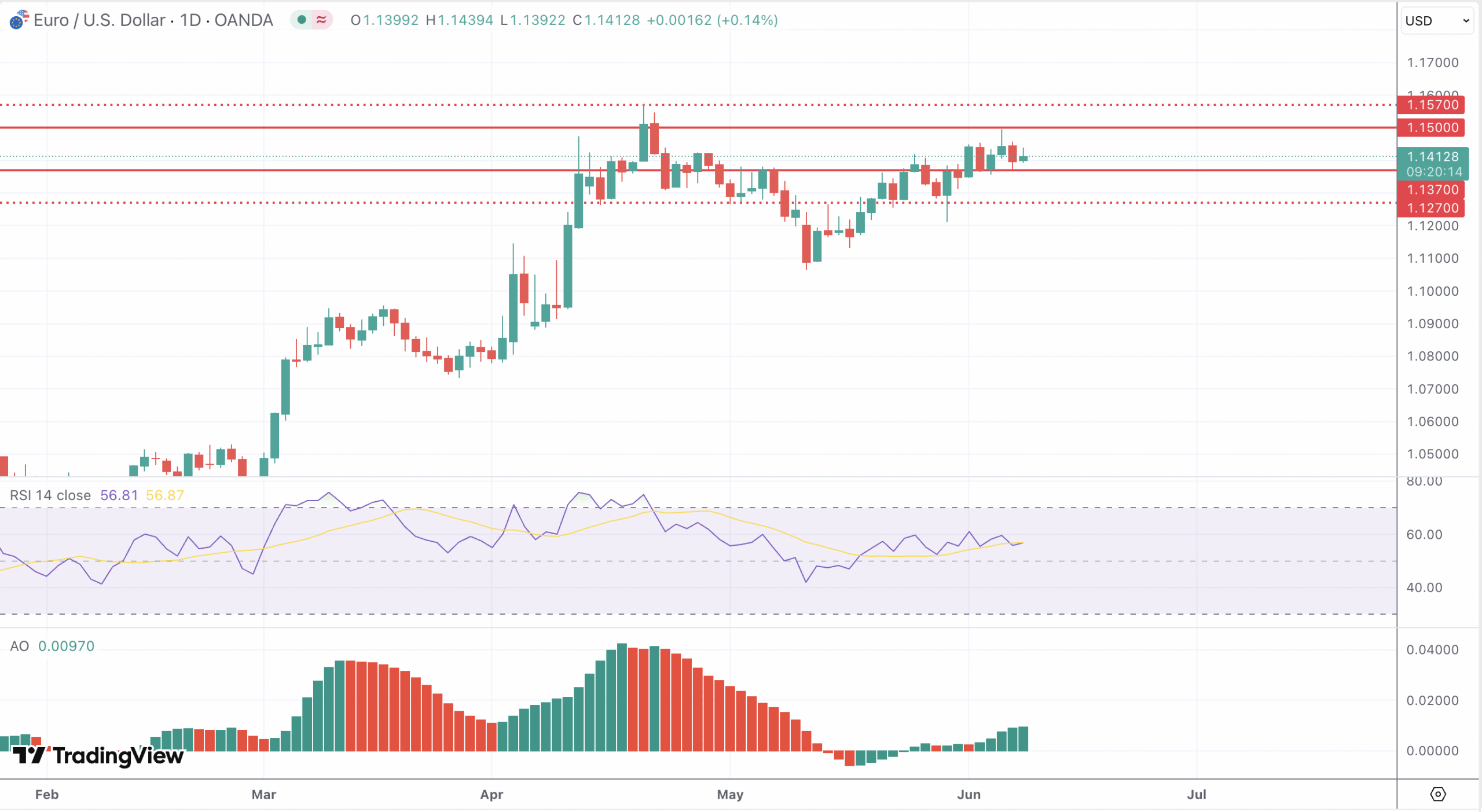

Technically, EUR/USD is in a bullish structure on the daily chart, maintaining higher highs and higher lows. The pair remains above both its 200-day and 50-day EMAs, confirming upward momentum. That said, the pair encountered resistance near 1.1570, forming a temporary top. Price action is now compressing between 1.1370 and 1.1500, forming a symmetrical triangle, often a precursor to a breakout.

Momentum indicators are beginning to show mixed signals. While the RSI remains above 50, it is flattening, and the Awesome Oscillator shows a mild bearish divergence, hinting at potential exhaustion in the recent bullish run. A developing Quasimodo reversal structure around 1.1490–1.1500 also warrants attention—especially if price begins to roll over beneath that resistance zone.

Fundamentally, the euro continues to benefit from expectations that the European Central Bank will maintain a relatively steady policy course, while the Fed faces increasing pressure to adjust depending on inflation and employment data. Upcoming US inflation numbers and labor reports will likely dictate the short-term direction of the pair. A stronger US CPI or employment print could support the dollar and weigh on EUR/USD, while softer data would reinforce bullish euro sentiment.

Looking Forward

Next week’s key focus is on US inflation and labor market indicators. Traders will be closely monitoring the Consumer Price Index, job openings (JOLTS), and next week’s updated payrolls report. Any downside surprises could significantly increase market bets on a Fed pivot, thereby weakening the dollar further.

Technically, a clear break above 1.1570 would confirm continuation of the broader uptrend, with room to target 1.1700 or even 1.1916, based on measured move projections. On the downside, a rejection from current levels could push EUR/USD back toward 1.1350–1.1360, a strong support band. A deeper correction may open the door to 1.1209, the previous swing low.

Short-term traders should also be aware of rising trading volumes at the 1.1370–1.1450 level, which could act as a magnet or springboard depending on the reaction to US data. Watch for breakout setups as volatility could rise sharply with macro releases.