Key Takeaways

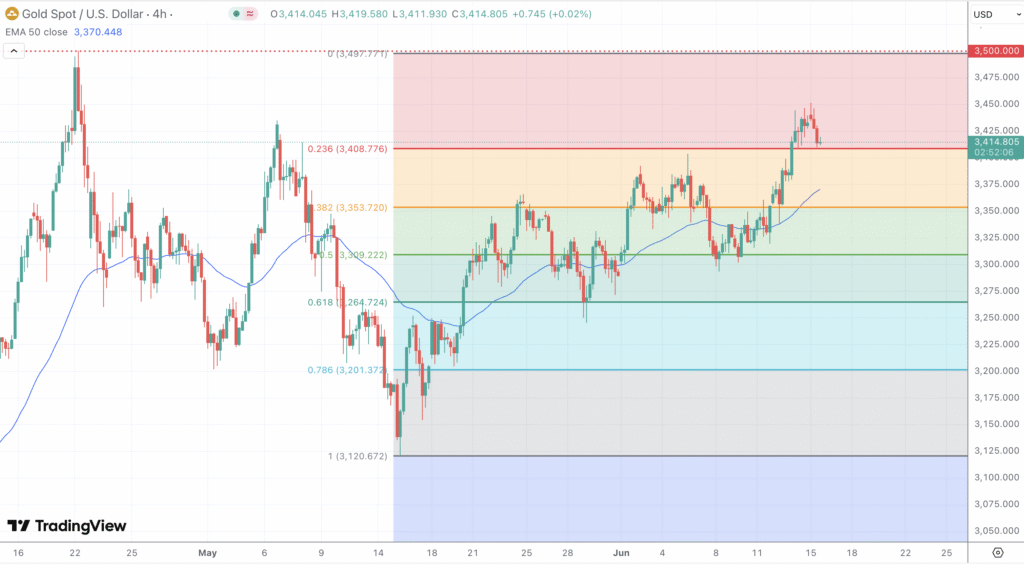

- Gold is currently trading around $3,413, just below last week’s high of $3,452.

- Near-term support lies at $3,408, followed by $3,398 and $3,365 based on Fibonacci retracements.

- Momentum indicators are neutral, suggesting consolidation rather than reversal.

- A break above $3,452 could open the door to $3,500.

- The Fed’s tone and U.S. inflation data are this week’s key catalysts.

- Long-term bullish factors remain intact: central bank demand, weakening dollar, and U.S. fiscal imbalances.

Market Dynamics and Recent Performance

Gold is currently trading around $3,413, easing slightly from last week’s high near $3,452. The pullback appears driven by profit-taking and short-term positioning ahead of a critical week for economic data and Federal Reserve commentary. Despite the retracement, gold remains elevated compared to previous months, underpinned by persistent geopolitical risk, slowing inflationary pressure, and growing confidence in eventual rate cuts from the Fed.

Markets have been grappling with mixed macro signals: while job growth has shown signs of cooling, inflation remains sticky enough to leave policymakers cautious. Still, the broader narrative continues to favor gold, with the U.S. dollar softening and real yields retreating modestly.

Technical and Fundamental Influences

Gold remains technically bullish, although the current price action suggests a consolidative phase. After hitting a local top near $3,452, gold pulled back toward $3,408, which coincides with an important horizontal support area. So far, this level has held, showing resilience in underlying demand.

The 23.6% Fibonacci retracement of the April–June rally lies near $3,408, while the 38.2% level is close to $3,353, offering potential entry zones for longer-term bulls. Should the price breach $3,408 decisively, these retracement levels may be tested next.

Momentum indicators like RSI are neutral, sitting around 52, showing that gold is neither overbought nor oversold. The MACD histogram is contracting, suggesting waning bullish momentum but no immediate bearish crossover. Overall, the price remains within an ascending channel pattern dating back to mid-April.

From a macro perspective, central bank gold accumulation continues to support the market structurally, alongside persistent U.S. fiscal concerns. Expectations are building for the Fed to start cutting rates later this year, particularly if inflation data shows further deceleration. Any signal that confirms this pivot could unleash a fresh wave of buying.

Looking Forward

This week will be critical for gold. Investors are watching Wednesday’s Fed meeting for clues about monetary policy direction, while U.S. CPI and PCE inflation data are expected to heavily influence rate expectations.

If the Fed signals dovish intent and inflation data underperforms, gold could rebound sharply toward $3,452 and challenge the psychological $3,500 resistance level. Conversely, a more hawkish tone or upside inflation surprises might pressure gold toward $3,398 and, if broken, deeper support near $3,365.

The current range between $3,408–$3,452 is pivotal. A breakout above that upper band would confirm the continuation of the bullish trend, while a failure to hold above $3,398 could shift sentiment toward a medium-term correction.