重要なポイント

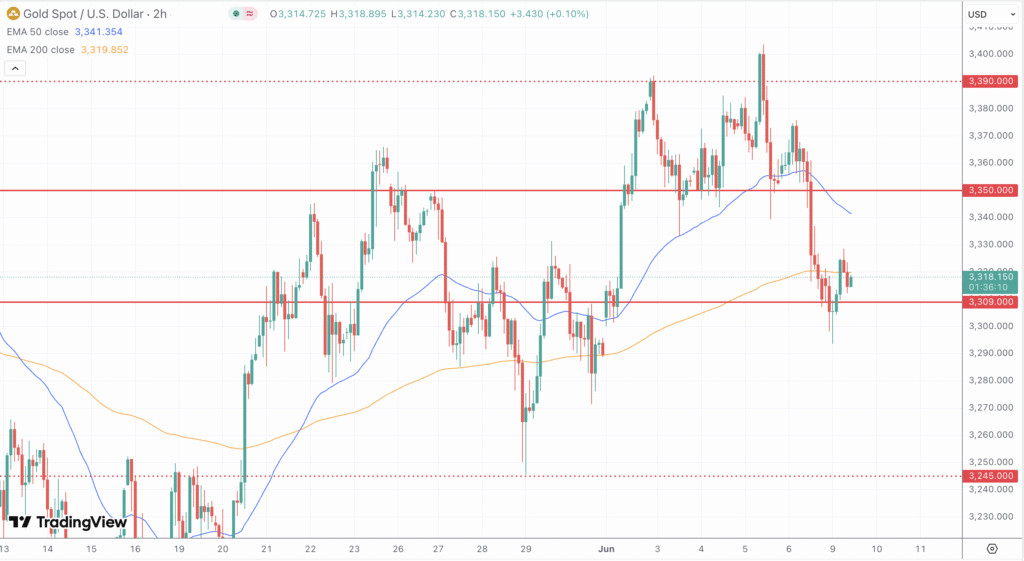

- Gold remains range‑bound near $3,300–$3,350, influenced by a softer dollar and trade concerns.

- Technical setup shows a potential bullish reversal if Gold clears $3,343–$3,350 zone; failure to do so could retest $3,290–$3,245.

- Fed expectations have shifted, reducing the likelihood of near‑term cuts; Treasury yields near 4.3% continue to weigh.

- Next week’s US data and trade outcomes will be decisive: weak data or trade uncertainty favors Gold; strong prints may press it lower.

- Volume and EMA levels offer tactical support—watch the 50‑ and 200‑EMA around midday charts for entry opportunities.

市場の動向と最近のパフォーマンス

Gold has been holding firm recently in the $3,300–$3,350 range, retracing from a near-2% drop late last week. The backdrop is a softer US Dollar ahead of the US‑China trade talks, lending support to bullion’s safe‑haven appeal.

Robust US labor data—139 k NFP jobs added in May, unemployment steady at 4.2%—has muted Fed rate‑cut expectations, keeping yields firm and under pressure from rising Treasury yields. Meanwhile, geopolitical and trade tensions continue to fuel demand for defensive assets.

テクニカルおよびファンダメンタルの影響

From a technical standpoint, Gold has recently formed a bearish engulfing candle and broken the lower boundary of its ascending channel, dragging prices down to near $3,290, the neckline of a minor head‑and‑shoulders pattern. This move triggered a bounce toward the previous support‑turned‑resistance zone near $3,340–$3,350.

Short‑term moving averages offer support: on the 2‑hour chart, the 50‑EMA ($3,343) and 200‑EMA ($3,319) are key inflection points. Traders are eyeing a sustained recovery above the 50‑EMA to claim bullish momentum, with resistance at $3,343–$3,350. A failure there could see another dip to the $3,309–$3,290 support region—and potentially toward $3,245 on a deeper pullback.

On the fundamentals, the Fed remains a central factor: rate‑cut probabilities for later this year have fallen from around 70% to the mid‑30s, given resilient labor and inflation metrics. Treasury yields—10‑year notes near 4.3%—are detracting from non‑yielding Gold. Still, dovish commentary, dovetailing with trade uncertainties and central bank reserve buying, continue to buoy bullion. A Reuters poll now forecasts average gold prices exceeding $3,000 in 2025, with risk to the upside if trade tensions persist.

今後の見通し

Heading into next week, the key events remain US‑China trade negotiations and US economic data: ADP payrolls, ISM Services PMI, and the June NFP report. A soft NFP print could reignite rate‑cut hopes, pushing yields lower and providing a tailwind to Gold. Technically, a clear break above $3,343–$3,350 could pave the way to $3,400–$3,450, possibly resuming the uptrend. Conversely, a strong US data beat or successful trade dialogue could drive USD strength and Treasury yields higher—prompting Gold to test the $3,290–$3,245 support range.

Volume patterns on shorter time frames also hint at a possible bullish reversal: recent retests of $3,309–$3,290 zones have seen increased volume, suggesting demand at those levels . Traders may watch for a bullish candle setup at the key support zone to consider re-entering long positions.